Inflation can be a persistent challenge for investors, often eroding the purchasing power of money. In the face of rising prices, many turn to silver as a hedge.

If you have a stake in silver, safeguarding your investment is paramount. Here are some strategies to protect your silver investment from inflation and ensure it retains its value over time.

1. Diversify Your Silver Holdings

One of the first steps in protecting any investment is to diversify. While silver is a valuable asset, putting all your eggs in one basket can be risky.

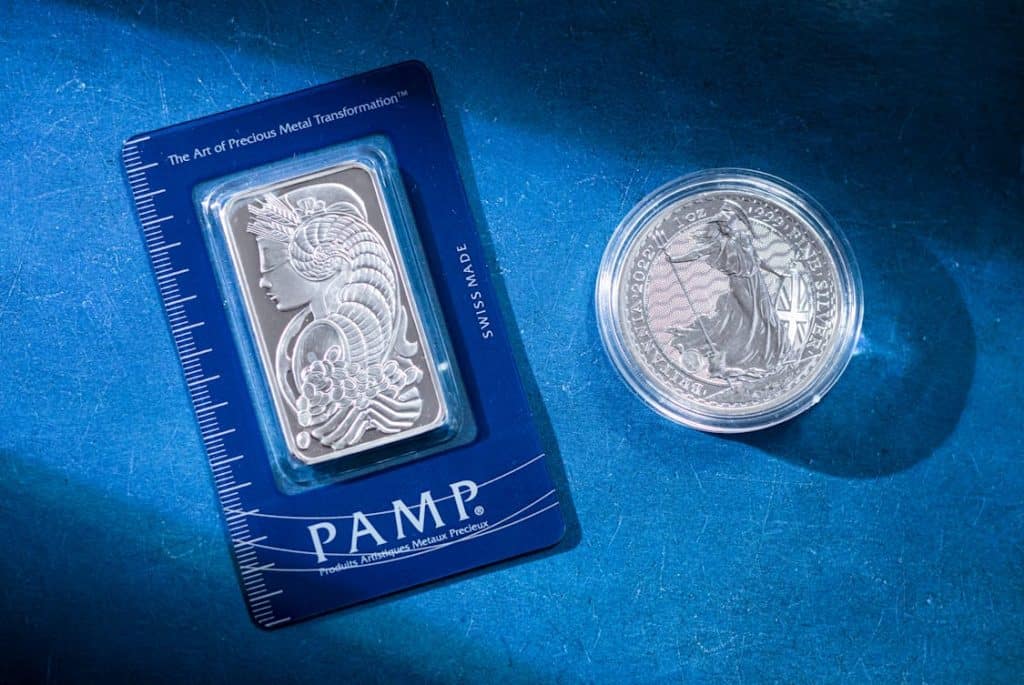

Consider holding various forms of silver, such as coins, bars, and even silver stocks. Each type has its own advantages and risks.

Silver coins often carry numismatic value, making them appealing to collectors and investors alike. On the other hand, silver bars are usually purer and easier to store in larger quantities.

By diversifying, you reduce the chance that a decline in one area will have a detrimental impact on your overall portfolio.

Moreover, look beyond silver to include other precious metals such as gold and platinum. A well-rounded investment strategy can help buffer against inflation’s effects, ensuring that your wealth isn’t solely reliant on silver.

Furthermore, think internationally. Silver markets can differ based on geographical factors and economic conditions. Investing in overseas silver assets may provide additional avenues for growth and protection against local inflationary pressures.

2. Store Your Silver Wisely

The way you store your silver can significantly affect its long-term performance. If you invest in physical silver, choosing a safe and secure storage solution matters.

Home safes may seem convenient, yet they come with risks, from theft to natural disasters.

Consider professional storage solutions that offer high security. Many companies provide vault services, protecting your silver in a controlled environment.

Look for facilities with insurance coverage, ensuring you’re compensated for any unforeseen circumstances.

Additionally, keep records of your silver holdings. Documentation of purchases, appraisals, and any relevant certificates can be invaluable should you need to sell or assess your assets.

Proper record-keeping can safeguard your investment and clarify its value during inflationary periods.

In case you’re considering selling, familiarize yourself with potential buyers. Knowing the market and having established connections can help you find a fair price when it comes time to liquidate your holdings.

3. Stay Informed About Market Trends

Awareness of economic indicators is key to protecting your silver investment. Inflation doesn’t operate in a vacuum; it’s influenced by various factors, such as interest rates, geopolitical tensions, and supply-demand dynamics.

Regularly follow credible financial news sources to stay updated on these trends. For in-depth market insights and updates, Money Metals provides regular reports and analysis, helping you stay informed about precious metals trends.

Pay attention to central bank policies. Changes in monetary policy can have significant implications for inflation rates and precious metals.

When interest rates rise, the appeal of silver (and other non-yielding assets) can fluctuate, potentially affecting its market value.

Engage with online forums and communities focused on silver investing. These platforms can be rich sources of information and insights from fellow investors.

Participating in discussions can help you gauge sentiment and anticipate market shifts that may impact your investments.

Furthermore, consider subscribing to industry newsletters or following analysts who specialize in precious metals. Their expertise can provide valuable forecasts and keep you ahead of the curve in your investment strategy.

4. Consider Silver Mining Stocks

Investing in silver mining stocks can be a smart way to gain exposure to the silver market without holding physical metal. Mining companies often perform well during inflationary times, as their revenues increase when silver prices rise.

This can provide a hedge against inflation’s impact on your overall wealth.

When selecting mining stocks, look for companies with low production costs and strong management teams. Companies that can efficiently navigate operational challenges tend to weather storms better, making them solid choices for long-term investments.

Additionally, consider exchange-traded funds (ETFs) that focus on silver mining. Such funds pool resources to invest in a range of mining companies, providing diversified exposure without having to pick individual stocks.

This strategy can minimize risk while still benefiting from potential silver price increases.

However, keep an eye on the operational costs of mining companies. Rising labor and energy prices can squeeze profit margins, potentially impacting stock performance.

Understanding these dynamics will help you make informed decisions about which mining stocks to include in your portfolio.

5. Use Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money into silver at regular intervals, regardless of market conditions.

This approach can be particularly effective in volatile markets, allowing you to buy more silver when prices are low and less when they are high.

By consistently investing, you can mitigate the impact of market fluctuations on your overall investment. Over time, this strategy can lead to a lower average cost per ounce of silver, making it easier to protect your investment from inflation.

Moreover, dollar-cost averaging encourages a disciplined approach. It removes the emotional aspect of investing, helping you avoid decisions driven by fear or greed.

Sticking to a predetermined schedule can provide peace of mind, knowing you’re steadily building your silver holdings.

To implement this strategy, set a budget for your silver investments and choose a frequency that works for you—be it monthly or quarterly. Adjust your plan as your financial situation changes, ensuring it remains aligned with your overall investment goals.

In these uncertain economic times, protecting your silver investment from inflation requires a multifaceted approach.

By diversifying your holdings, storing them safely, staying informed about market trends, considering mining stocks, and employing dollar-cost averaging, you can fortify your position.

While inflation may be a challenge, a strategic approach can help safeguard your wealth and ensure your silver investment retains its value over the long haul.